The simple choice of saving energy.

JUMP RIVER ELECTRIC MEMBERS ONLY

Below you will find a detailed list of the 2026 Energy $ense rebates and incentives offered by Jump River Electric Cooperative. If you are an active electric member and you are implementing energy conservation into your home, these rebates will benefit you. Please make sure to read Overall Incentive Rules at the end of this list for other terms and conditions. You can email your questions to Denise Zimmer or call 715-532-5524.

If you qualify for a rebate or incentive, please continue as follows.

1. Click HERE to complete the appropriate rebate form(s) online, or

2. Complete, print, and return the appropriate fillable form(s) listed below by email or by mail to: Jump River Electric Cooperative, Attn: Rebates, PO Box 99, Ladysmith WI 54848.

AG, COMMERCIAL & INDUSTRIAL; APPLIANCES & APPLIANCE RECYCLING; COMPRESSED AIR AUDIT; ELECTRIC$ENSE NEW HOME AUDIT; ENERGY HOME AUDIT; EV CHARGERS; HVAC; LIGHTING; and WATER HEATERS;

3. All rebate form(s) and necessary documentation must be submitted within three (3) months of purchase date or by install date. Refer to the details under the product details to determine which deadline applies.

4. Rebates of less than $500 will be issued in the form of an energy credit. A check will be issued for rebates of $500 or more.

5. Don't forget to check the websites listed at the bottom of this page to see if you qualify for any energy-efficiency tax breaks or other rebates.

ENERGY STAR versus ENERGY GUIDE--WHAT YOU NEED TO KNOW.

ENERGY STAR certified products help you save energy. Look for the ENERGY STAR label, shown above, when you make your next purchase. This label is required for most of the Energy $ense rebates.

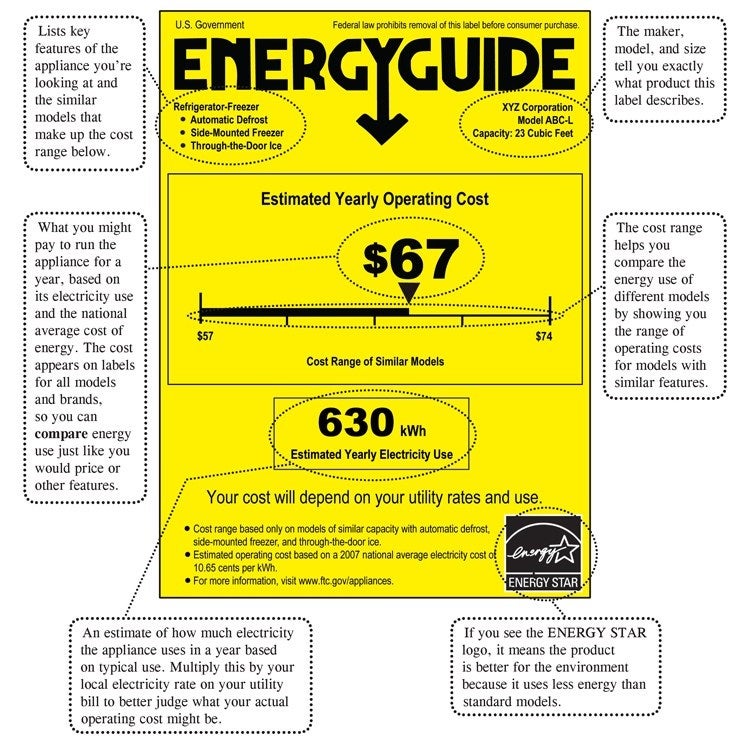

The EnergyGuide, that is attached to most appliances, does not indicate that the product is ENERGY STAR certified. The example below shows the ENERGY STAR symbol at the bottom right of this guide. Be sure to include a copy of the EnergyGuide with your rebate form.

Tax Credits for Consumers

Their may be tax credits available that can help subsidize the cost of energy-efficient home upgrades including heating, cooling, and water heating. You can look online at www.energystar.gov, www.energy.gov/save, www.energy.gov/home-energy-rebates, or contact your tax professional.